Where Does the Money Go?

A Deep Dive Into Arkansas's Budget

Hayden Dublois, Visiting Economist

February 2023

Key Findings:

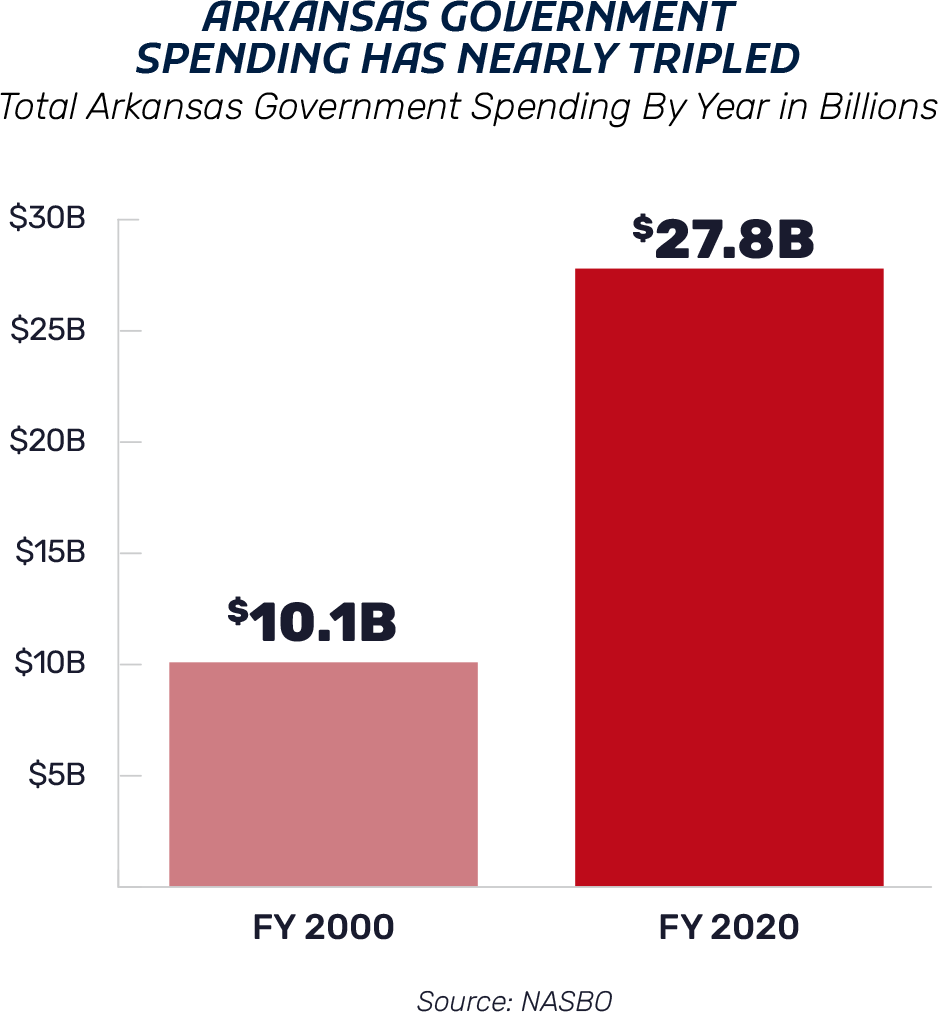

- Total Arkansas government spending has nearly tripled since 2000, now reaching nearly $30 billion annually

- Arkansas government spending is growing faster than Arkansans’ ability to pay for it

- Medicaid is the primary driver behind Arkansas’s government spending increases

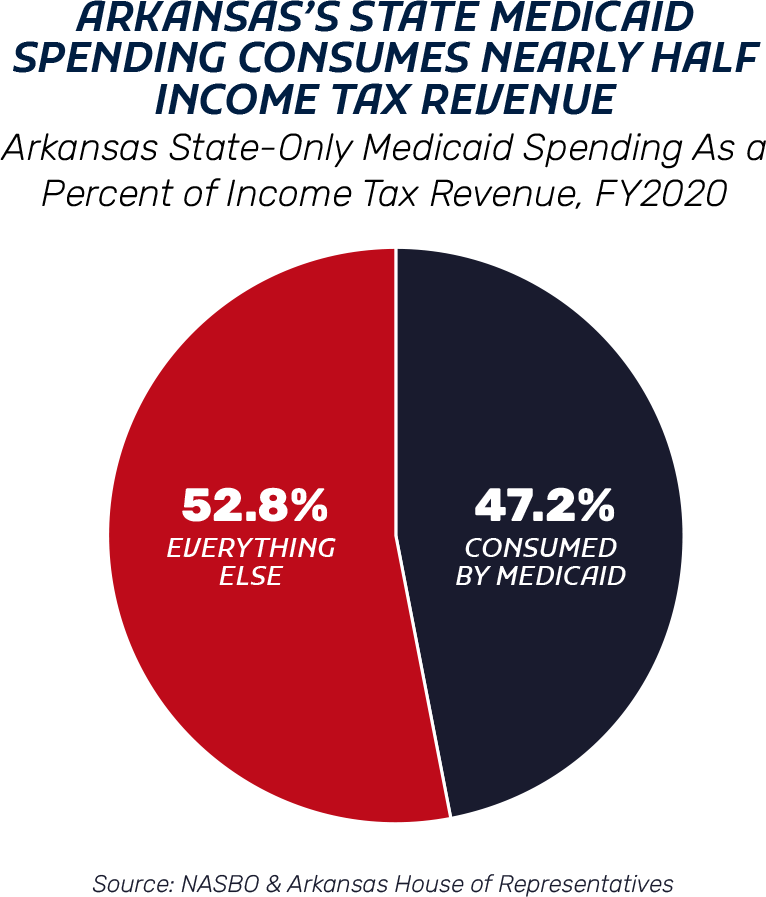

- Arkansas state-only Medicaid spending consumes nearly half of the state's income tax revenue

Bottom Line:

- To eliminate the state income tax and restore fiscal sanity, Arkansas policymakers must rein in spending

With nearly $30 billion spent annually by their state government, Arkansans are right to ask where their money is going—and how it compares to past government spending.1 Unfortunately, a cursory examination paints a bleak picture.

The state’s new legislature and new governor are being handed the keys to a runaway train: indeed, over just the past two decades, government spending in Arkansas has skyrocketed, growing faster than the state economy and faster than Arkansans’ paychecks.

This spending growth has not only made Arkansas increasingly dependent on the federal government—and Arkansans increasingly dependent on government benefits—but also threatens policymakers’ top priorities, such as eliminating the state income tax.

In order to repeal the state income tax, state spending must be reined in. And in order to rein in state spending, policymakers must have a thorough understanding of where taxpayer dollars are currently going and what line items are driving the state’s spending crisis.

TOTAL ARKANSAS GOVERNMENT SPENDING HAS SKYROCKETED SINCE 2000, NOW REACHING NEARLY $30 BILLION ANNUALLY

In FY2000, Arkansas state government spent roughly $10.1 billion dollars.2 Twenty years later, that amount had spiked to $27.8 billion—or a more than 175 percent increase.3

While a modest proportion of Arkansas’s government spending is from “federal dollars,” that distinction is often used to ignore or understate the significant contribution state taxpayer dollars are making toward this bloated state budget.

In fact, for every $3 spent by the State of Arkansas, only $1 comes from the federal government—meaning roughly two-thirds of state spending is financed directly by state taxpayers.4

Worth noting, special interests who de-emphasize the relevance of federal dollars spent by state government too often ignore this fact, as well as the harsh reality that drawing down federal dollars typically requires the state to put money up as well (in an arrangement known as a “federal match”). There are almost always significant strings attached when it comes to federal resources.

They also ignore the fact that every Arkansas taxpayer is also a federal taxpayer and any federal funds the state receives are at least in part a return of funding the state sent to the federal government.

Additionally, it is very possible that Arkansas’s unique and somewhat obscure state budgeting process has contributed to the explosion of state spending. In Arkansas, broad funding requests are categorized and prioritized—so that high-priority items get funded first in the event revenues fall short— after which the budget bill is filled.5

On the one hand, this approach can prevent deficit spending by tiering priorities and linking them to revenue collections. On the other hand, by prioritizing funding requests before the specifics of the budget bill are filled, the process could be discouraging initial fiscal scrutiny of the state budget.

In any case, it is clear that Arkansas’s budget has grown to an unsustainable point.

ARKANSAS GOVERNMENT SPENDING IS GROWING FASTER THAN ARKANSANS’ ABILITY TO PAY FOR IT

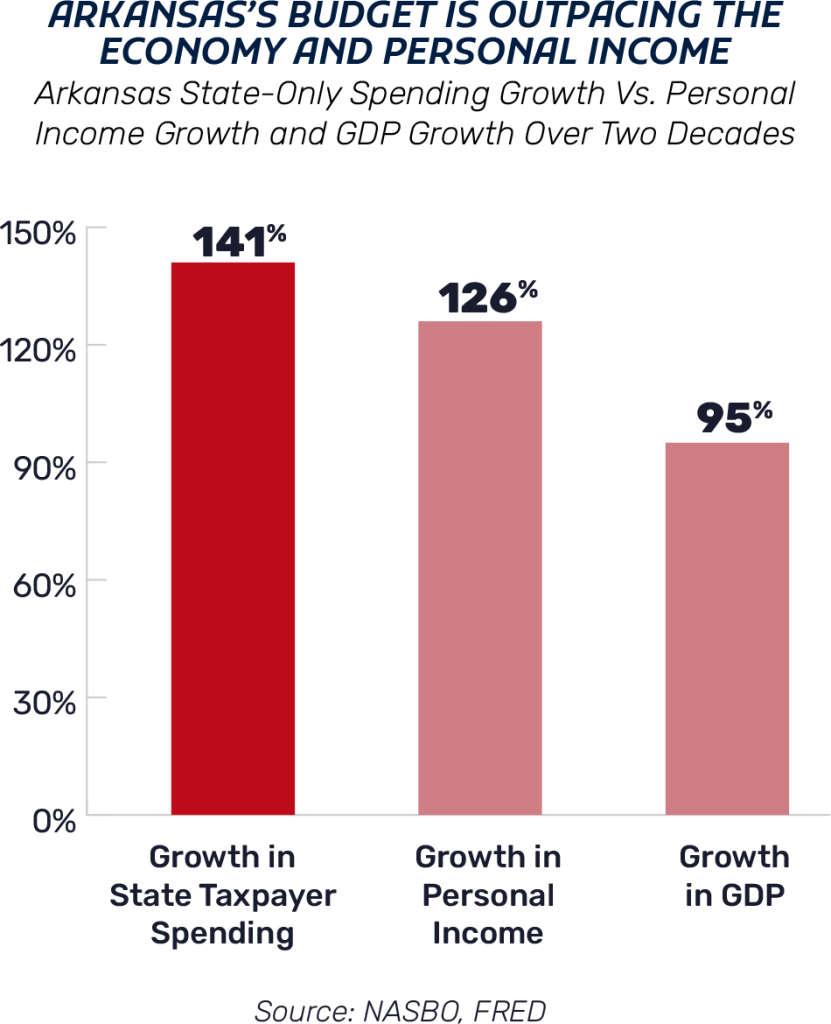

While total government spending in Arkansas has increased by more than 175 percent over the past two decades, this dwarfs the state’s economic and personal income growth over the same period.6 From 2000 to 2020, personal income in Arkansas grew by roughly 126 percent, while the state’s gross domestic product (GDP) grew by just 95% percent.7-8

In other words, government spending in Arkansas is growing faster than the overall economy and Arkansans’ personal incomes.

Even if federal spending is excluded from the total, Arkansas state-only government spending has increased by 141 percent over the past two decades—roughly 4.6 times faster than the growth in the state’s economy. 9

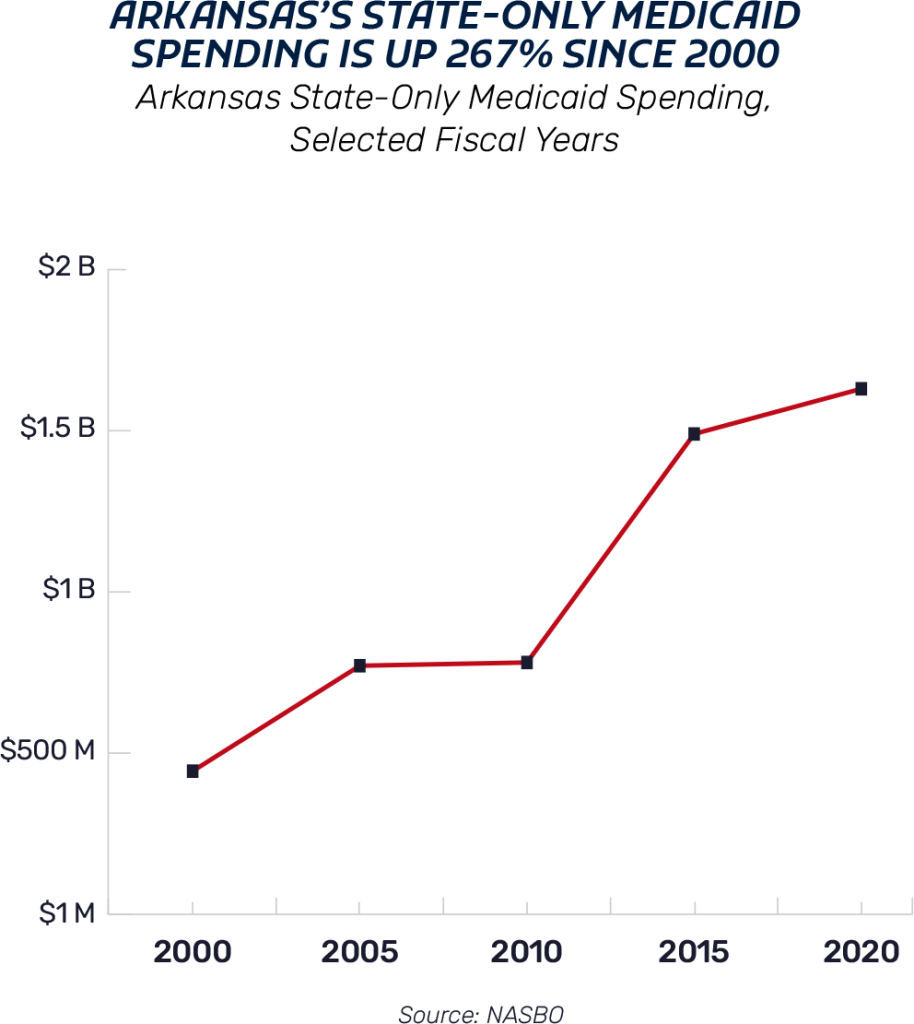

MEDICAID IS THE PRIMARY DRIVER BEHIND ARKANSAS’S GOVERNMENT SPENDING INCREASES

While it may not be policymakers’ favorite subject, there is simply no avoiding this reality: the state’s Medicaid program is driving Arkansas’s spending explosion.

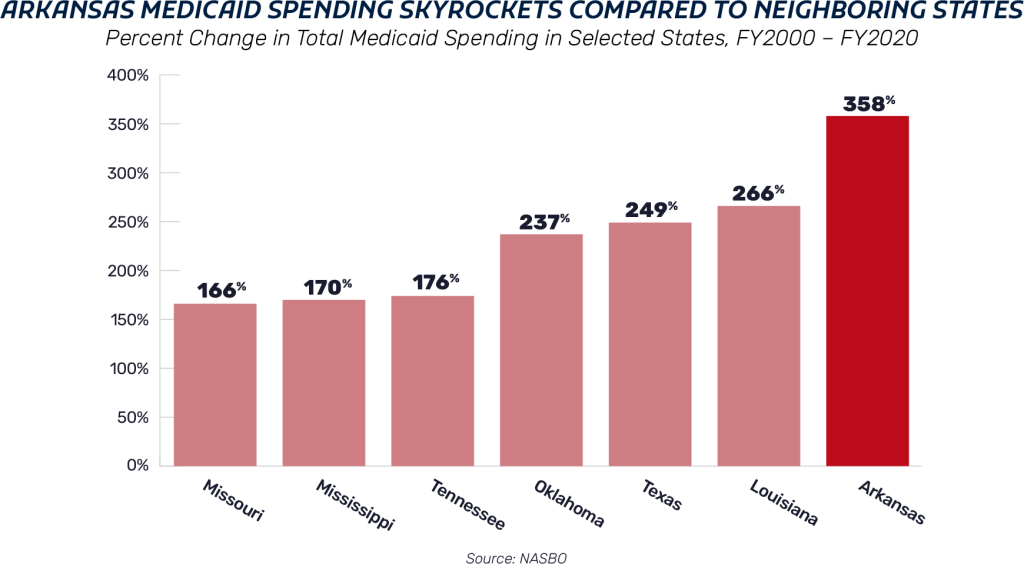

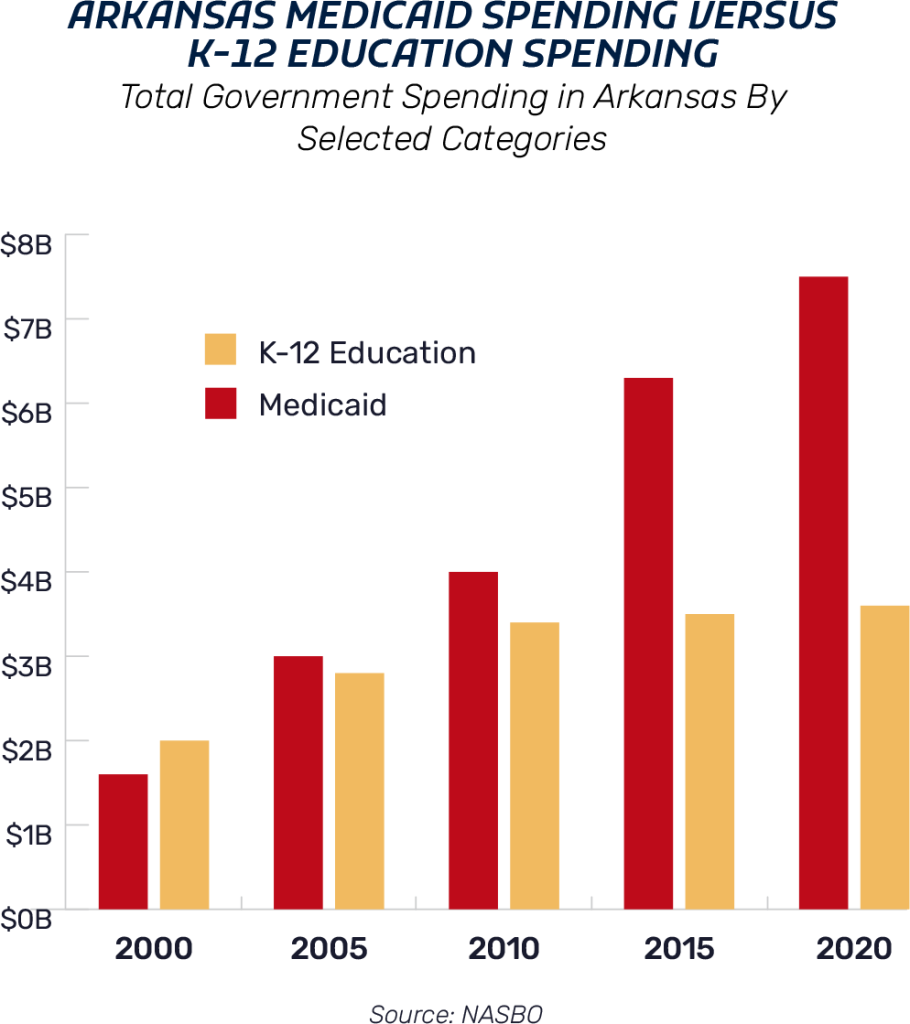

In FY2000, Medicaid spending was at roughly $1.6 billion.10 Today, Arkansas spends approximately $7.5 billion on Medicaid—an astonishing increase of about 358 percent, or more than double the rate of growth of the next-highest spending category.11- 12 That is more than twice the rate of growth compared to neighboring states like Tennessee, Mississippi, and Missouri.13

In fact, despite having nearly identical spending levels in FY2000, Arkansas’s Medicaid spending has grown nearly five times faster than its K-12 education spending since that time.14

Most of the increase in the state’s Medicaid program occurred after 2010, when the state expanded Medicaid to able-bodied adults under Obamacare.15 While this was pitched as a primarily federally-financed effort, it is clear the impact to state taxpayers is actually substantial.

In fact, even after excluding federal funds, Medicaid spending in Arkansas grew by roughly 267% between FY2000 and FY2020—more than any other category of state taxpayer-financed spending.16 It is indisputable that state taxpayers are bearing a significant cost to finance an expanded Medicaid program that serves able-bodied, working-age adults.

MEDICAID DOMINATES ARKANSAS’S BUDGET

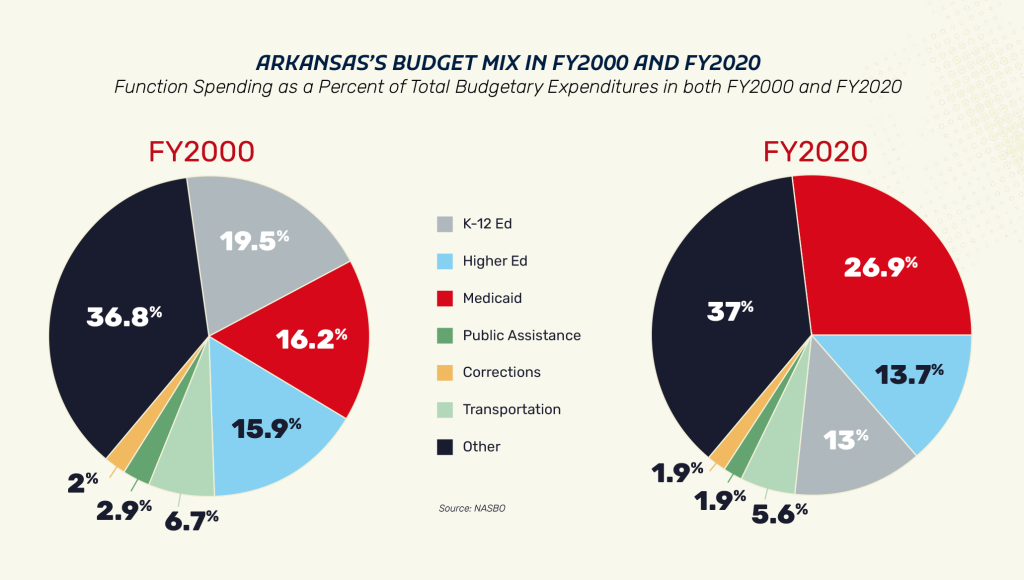

While Medicaid spending has gone through the roof in Arkansas since FY2000, every other category of spending has declined or stayed flat as a percentage of total budgetary expenditures.17

This explosion in Medicaid spending spells major problems for Arkansas. First, it has essentially “crowded out” spending on other key priorities, such as education. Second, it has greatly increased the state’s reliance on the federal government, granting them significant leverage. Third, it has fostered a massive increase in government dependency as more and more Arkansans are added to the Medicaid rolls—with more than one in every three Arkansas residents on the program—especially able-bodied adults under Obamacare.18 And finally, without meaningful reform, it places a repeal of the state income tax out of reach. In fact, Arkansas’s state-only Medicaid spending consumes nearly half of revenue raised by the state income tax. 19-20-21

Bottom Line

Spending reform is an essential component of income tax repeal

Arkansas’s government is growing well beyond the capacity to pay for it, even after factoring out federal dollars. Overall state-taxpayer financed spending is increasing faster than state GDP and personal income, creating a $30 billion behemoth. Medicaid is driving this trend, as it alone accounts for one-third of the increase in total Arkansas government spending over the last two decades.22

To rein in spending to a more manageable level, Arkansas policymakers will have to make difficult decisions—especially around the state’s Medicaid program.

WITHOUT MEDICAID REFORM, PHASING OUT THE STATE INCOME TAX IS GOING TO BE VERY DIFFICULT.

Specifically, to rein in state spending, Arkansas policymakers should:

- Remove ineligible enrollees from the Medicaid program as soon as possible beginning in April 2023 (when the federal “Medicaid handcuffs” expire);

- End the “private option” model for Medicaid expansion that is twice as expensive as conventional expansion;23

- Pursue a comprehensive pro-Arkansas Medicaid waiver that promotes work and accountability, using the prospect of repealing the expansion program as leverage with the federal government;

- Reduce the state workforce across the board, which has grown beyond recognition (currently, Arkansas has nearly 2-to-1 the number of state employees as some surrounding states, when accounting for population);24

- Cap out-of-control state employee pay for high-earning bureaucrats;25

- Delist non-essential Arkansas government job openings;

- Tie Arkansas’s budget growth rate to the rate of growth of Arkansans’s incomes;

- Eliminate corporate welfare giveaways like the Quick Action Closing Fund (QACF);

- Implement more pro-work policies in welfare programs, such as mandatory employment and training in the state’s food stamp program; and

- Reduce state general revenue spending by a fixed amount for every department.

Endnotes:

1. National Association of State Budget Officers, “2022 State Expenditure Report,” NASBO (2022), https://higherlogicdownload.s3.amazonaws.com/NASBO/9d2d2db1-c943-4f1b-b750-0fca152d64c2/UploadedImages/Reports/2022_State_Expenditure_Report_-_S.pdf.

2. National Association of State Budget Officers, “Summer 2002 State Expenditure Report,” NASBO(2002), https://higherlogicdownload.s3.amazonaws.com/NASBO/9d2d2db1-c943-4f1b-b750-0fca152d64c2/UploadedImages/SER%20Archive/nasbo2001exrep.pdf.

3. Author’s calculations of the percent change in total budgetary expenditures in the State of Arkansas between FY2000 and FY2020 as reported by the National Association of State Budget Officers.

4. National Association of State Budget Officers, “2022 State Expenditure Report,” NASBO (2022), https://higherlogicdownload.s3.amazonaws.com/NASBO/9d2d2db1-c943-4f1b-b750-0fca152d64c2/UploadedImages/Reports/2022_State_Expenditure_Report_-_S.pdf.

5. Christine Vestal, “The Arkansas Approach: How One State Has Avoided Fiscal Disaster,” The Pew Charitable Trusts (2011), https://www.pewtrusts.org/en/research-and-analysis/blogs/stateline/2011/09/20/the-arkansas-approach-how-one-state-has-avoided-fiscal-disaster.

6. Author’s calculations of the percent change in total budgetary expenditures in Arkansas betweenFY2000 and FY2020 as reported by the National Association of State Budget Officers.

7. Federal Reserve Bank of St. Louis, “Gross Domestic Product: All Industry Total in Arkansas,” FRED(2022), https://fred.stlouisfed.org/series/ARNGSP.

8. Federal Reserve Bank of St. Louis, “Total Personal Income in Arkansas,” FRED (2022), https://fred.stlouisfed.org/series/AROTOT.

9. Author’s calculations of the percent change in state-financed budgetary expenditures in the State of Arkansas between FY2000 and FY2020 as reported by the National Association of State Budget Officers.

10. National Association of State Budget Officers, “Summer 2002 State Expenditure Report,” NASBO (2002), https://higherlogicdownload.s3.amazonaws.com/NASBO/9d2d2db1-c943-4f1b-b750-0fca152d64c2/UploadedImages/SER%20Archive/nasbo2001exrep.pdf.

11. National Association of State Budget Officers, “2022 State Expenditure Report,” NASBO (2022), https://higherlogicdownload.s3.amazonaws.com/NASBO/9d2d2db1-c943-4f1b-b750-0fca152d64c2/UploadedImages/Reports/2022_State_Expenditure_Report_-_S.pdf.

12. Author’s calculations of the percent change in total Medicaid expenditures in Arkansas between FY2000 and FY2020 as reported by the National Association of State Budget Officers.

13. Author’s calculations of the percent change in total Medicaid expenditures in selected states between FY2000 and FY2020 as reported by the National Association of State Budget Officers.

14. Author’s calculations of the percent change in total K-12 education expenditures in Arkansas between FY2000 and FY2020 as reported by the National Association of State Budget Officers.

15. Author’s analysis of the change in total Medicaid expenditures in Arkansas between FY2000 and FY2020 as reported by the National Association of State Budget Officers.

16. Author’s calculations of the percent change in state-financed Medicaid expenditures in Arkansas between FY2000 and FY2020 as reported by the National Association of State Budget Officers.

17. Author’s analysis of the proportion of itemized function expenses as a share of total budgetary expenses in Arkansas between FY2000 and FY2020 as reported by the National Association of State Budget Officers.

18. Opportunity Arkansas, “Roadmap to Opportunity,” Opportunity Arkansas (2022), https://www.opportunityarkansas.org/roadmap2023.

19. National Association of State Budget Officers, “2022 State Expenditure Report,” NASBO (2022), https://higherlogicdownload.s3.amazonaws.com/NASBO/9d2d2db1-c943-4f1b-b750-0fca152d64c2/UploadedImages/Reports/2022_State_Expenditure_Report_-_S.pdf.

20. Arkansas House of Representatives, “Fiscal Year 2021 General Revenue,” Arkansas (2022), https://www.arkansashouse.org/news/post/15060/new-fiscal-year.

21. In FY2020, Arkansas spent $1,629,000,000 in state dollars on Medicaid and collected approximately $3.45 billion in income tax revenue.

22. Opportunity Arkansas, “Roadmap to Opportunity,” Opportunity Arkansas (2022), https://www.opportunityarkansas.org/roadmap2023.

23. Jonathan Ingram, “Arkansas’s So-Called Conservative approach to ObamaCare Expansion Has Failed, ”Foundation for Government Accountability (2020), https://thefga.org/wp-content/uploads/2020/10/Arkansas-so-called-conservative-approach-to-ObamaCare-expansion-has-failed.pdf.

24. Opportunity Arkansas, “Roadmap to Opportunity,” Opportunity Arkansas (2022), https://www.opportunityarkansas.org/roadmap2023.

25. Hayden Dublois, “It’s Time to Talk About Out-Of-Control Arkansas Government Salaries,” Opportunity Arkansas (2022), https://www.opportunityarkansas.org/our-work/its-time-to-talk-about-out-of-control-ar-government-salaries.